Thursday 22 January 2026

Major Takeaways from Union Budget 2024

Share

On 23rd July, Nirmala Sitharaman, Indias Finance Minister, presented the Union Budget 2024-2025 in Parliament. This budget marks her seventh budget in a row under the Narendra Modi-led India Government and the first budget of the BJP-led alliance.

The union budget provides an overview of the governments financial strategy for the upcoming fiscal year, encompassing both revenues and expenditures. Below are some key highlights:

The budget is designed to foster a prosperous and equitable India by 2047, with a key emphasis on boosting economic growth, generating employment opportunities, and enhancing infrastructure.

The Finance Ministers speech covers discussions on economic circumstances, policy measures and industry-specific funding distributions.

It provides understanding of the governments priorities and fiscal management.

The Annual Union Budget in India is a crucial financial event that details the governments revenue and expenditure for the next fiscal year.

Below is how the budget speech is presented and the structure of the speech:

In Lok Shaba (the lower house of the Parliament), the finance minister presents the Union Budget, which is an event held usually in February.

The presentation of the union budget comprises the finance bill, which outlines tax proposals and the appropriation bill, which authorizes government expenditures.

The budget needs to be approved by the Lok Sabha before it can be effective on April 1, the start of Indias financial year.

The budget speech delivered by the finance minister is divided into two primary segments: Part A and Part B

Part A of the budget speech begins with a thorough examination of past and present economic situations. It also provides a summary of economic expansion, inflation, budget deficits and other important aspects.

Part B of the budget speech includes the current budget projections, funding distribution and policy declarations. It encompasses different areas like farming, education, healthcare, infrastructure and defense. It also highlights important programs, tax revisions and government priorities.

The Union Budget is expected to bring changes to income tax structures, developments in infrastructure, job creation and measures for supporting the farmers. Although tax relief is expected to maintain fiscal discipline, which is important.

PM Package:

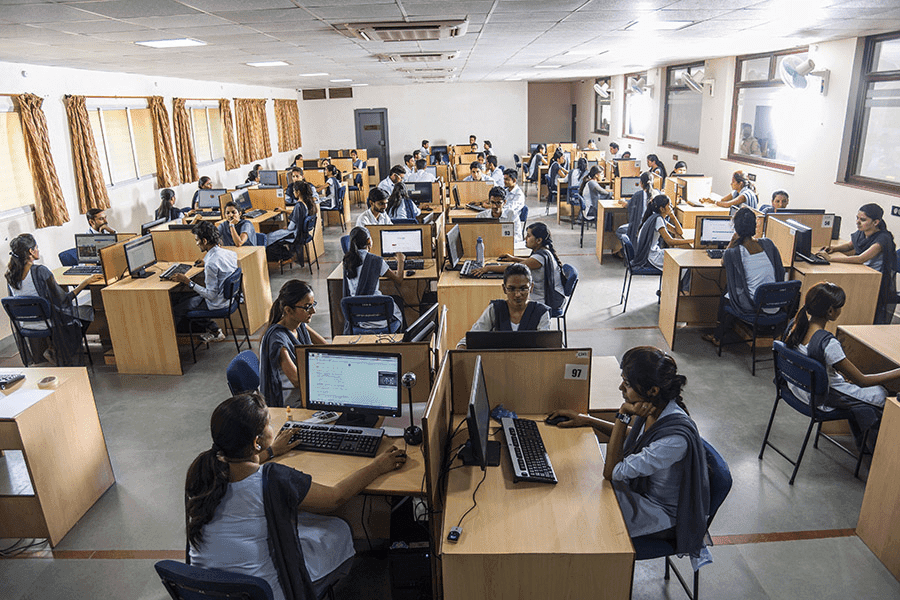

5 schemes with 2 lakh crore allocation from employment and skilling.

Budget Provision:

1.48 lakh crore for employment, education and skilling.

Incentives for First-Time Employees:

Higher Education Support:

Financial assistance for loans up to 10 lakh.

Youth Internships:

Jobs in Manufacturing

Scheme to incentivize job creation in manufacturing:

Bihar:

Andra Pradesh

Odisha

Mudra Loans:

Limit enhanced from 10 lakh to 20 lakh for those who have availed and successfully repaid loans previously taken under the Tarun category.

New Credit Guarantee Scheme:

A new credit guarantee scheme to enable collateral-free term loans for machinery and equipment with the cover of up to 100 crore.

Angel and Income Tax

Abolish Angel Tax: Eliminating angle tax for all investor classes

Income Tax Act Review

A comprehensive review of the Income-tax Act, 1961 in six months to make it concise, lucid and reduce disputes and litigation.

TDS Changes

Capital Gains Tax

10 lakh crore to address housing needs for one crore poor and middle class, including 2.2 lakh crore of central assistance over five years.

Develop 100 weekly haats or steet food hubs in select cities

For 14 large cities with a population above 30 lakhs

Water supply, sewage treatment and solid waste management projects and services for 100 large cities

2.66 lakh crore for rural development, including construction of three crore houses.

To be increased through hostels and women-specific skilling programs.

218.8% rise in womens welfare and empowerment funding from FY14 to FY25.

States are encouraged to lower stamp duties for properties purchased by women.

PM Surya Ghar Muft Bijli Yojana offers free electricity up to 300 units per month to 1 crore households by installing rooftop solar plants. The focus is on developing small and modular nuclear reactors.

Plan to quintuple the space economy over the next 10 years, supported by a 1,000 crore venture capital fund.

Exemption of customs duties on three cancer drugs

Developing tourism corridors at Vishnupad and Mahabodhi Temples and supporting Nalanda as a tourist center.

Newsletter

Stay up to date with all the latest News that affects you in politics, finance and more.