Saturday 7 March 2026

China’s Dynamic New Package to Boost Economic Recovery

Share

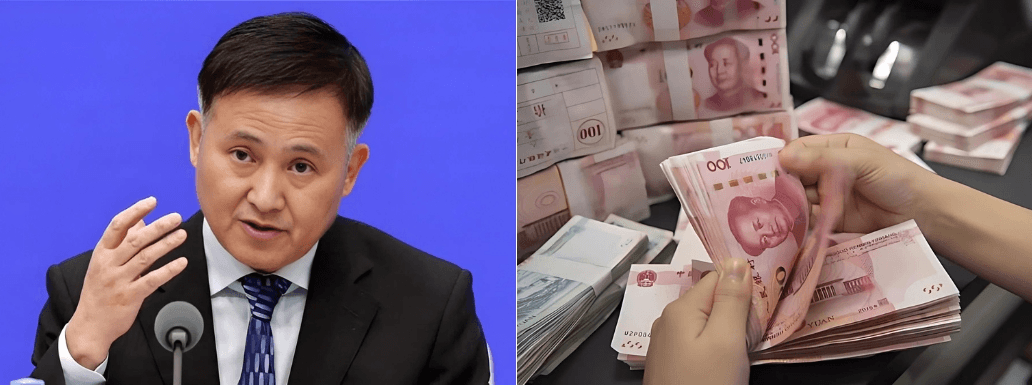

Chinas central bank has announced a significant package of measures designed to revive the countrys struggling economy. The Peoples Bank of China (PBOC) is implementing steps to reduce borrowing costs. PBOC also encourages banks to increase their lending practices.

This initiative comes in response to underwhelming economic data. The data has raised concerns that the worlds second-largest economy may not meet its growth target of 5% this year.

PBOC Governor Pan Gongsheng revealed some key measures during a rare news conference, accompanied by officials from two other financial regulatory bodies. These key measures include:

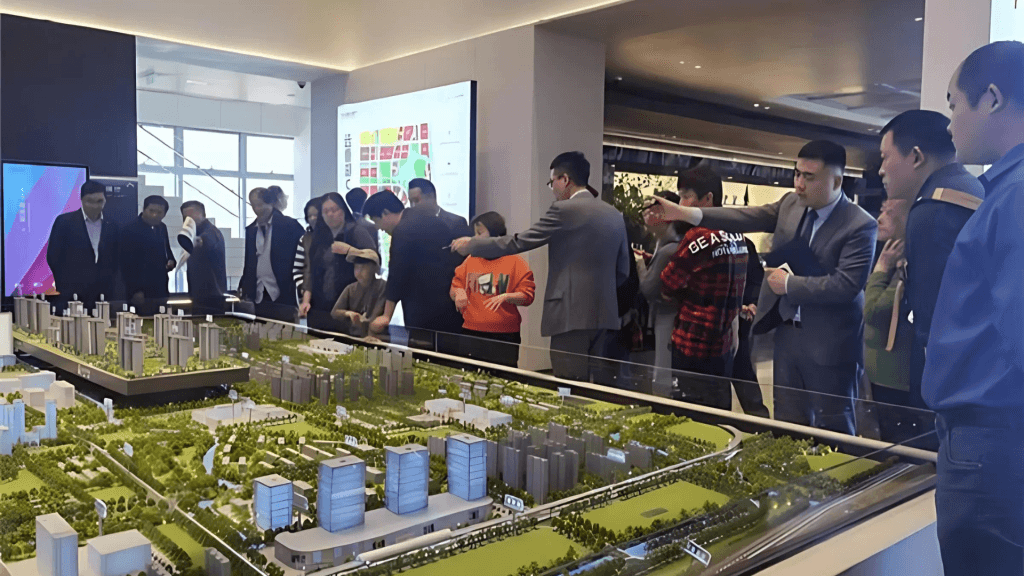

In addition to lowering reserve requirements, the PBOC is implementing measures specifically designed to assist the beleaguered property sector. These initiatives involve reducing interest rates on existing mortgages and lowering the minimum down payment for all types of homes to 15%.

The real estate industry has faced considerable difficulties since 2021, with many developers going bankrupt and leaving behind unsold properties and incomplete projects. These new measures aim to revitalize the property market and rebuild trust among buyers and investors.

The announcement of these economic stimulus measures quickly influenced stock markets throughout Asia. Following Mr. Pans disclosure, share prices surged, with the leading stock indexes in Shanghai and Hong Kong closing more than 4% higher. The positive response reflects market optimism about the likely success of the PBOCs efforts to stimulate economic growth.

The actions taken by the Peoples Bank of China (PBOC) follow the U.S. Federal Reserves recent decision to reduce interest rates for the first time in more than four years. Chinas newly implemented economic strategies reflect a broader trend of central banks responding to economic slowdowns with supportive policies.

Chinas central bank has implemented significant measures to tackle the economic challenges it is currently facing. It especially follows unsatisfactory growth projections. By reducing borrowing costs and introducing initiatives to bolster the property sector, the Peoples Bank of China seeks to encourage lending and revive economic activity.

Newsletter

Stay up to date with all the latest News that affects you in politics, finance and more.